Thoughts On Emerging Legal Issues At The Intersection Of Finance, Blockchain And Law

Blog

SoulBound NFTs: use case

Ensuring fairness in the distribution of hyped NFT Mints

NFT projects and communities are often destroyed by the actions of a few who are able to earn a disproportionate number of whitelist spots and/or take advantage of errors in the smart contract code during minting. In this post, I discuss how soulbound NFTs may be utilized to increase unique holder count for hyped NFT projects, thereby increasing the probability that an NFT project survives post-mint.

1. The Problem – Mekaverse Case Study

Whale/bot accumulation of NFTs and subsequent flipping are not only legal, but also desirable in many cases because they generate large secondary volume. However, anyone who has been in the NFT space for long enough understands that there are really a few metrics that matter for the project long-term: 1) the NFT community itself; 2) the number of unique holders of the NFT (also an indicator of community); and 3) consistent volume (secondary market sales). Whales who have a large number of the NFTs in a collection can artificially keep prices high and leave secondary market buyers who purchase at the exorbitant prices “holding the bag”. Whales can also dump on the market at will.

In the case of Mekaverse, the floor price for the collection, which at one point was 8 ETH ($40K USD at the time) currently sits at 0.28 ETH (approximately $500 USD). I believe the implementation of soul-bound NFTs is ideal for hyped mints like Mekaverse to avoid whale manipulation and ensure a fairer distribution of tokens during mint, leading to an improved outlook for the project in the long-run.

I envision soulbound tokens to be implemented through a single trusted entity that KYC’s users and administers a single soulbound “identity” token among the many addresses a user might have. For example, a large marketplace like Opensea or wallet like Metamask could have an “Opensea/Metamask Bound Token” that is distributed to a user’s primary account following identity verification. This soulbound token would be tied to a single Ethereum address and be non-transferrable. These entities are arguably also well-positioned to identity instances of fraud, such as through a user’s IP address.

NFT projects could subsequently combine soulbound tokens for identity verification with other criteria, such as their most active discord users, to ensure that whitelist spots go to unique users that are truly interested in being members of their community. The smart contract would have to be programmed to allow NFT minting only to those with a soulbound token (for example, 1 NFT per soulbound token). This mechanism would result in more unique users who are able to mint the NFT and alleviate problems associated with bot-farming/whale accumulation as noted in the Mekaverse example above. Ultimately, this would ensure a fairer token distribution at mint, increasing the chances that a project survives thereafter. It would further remove the need for users to have to give identifying information to many NFT projects for KYC purposes – the drawbacks, of course, are the privacy implications for users and how entities use/store their data.

Soulbound token implementation has already began in the NFT space, but not in the context of identity as articulated above but in the context of rewarding long-term NFT holders.

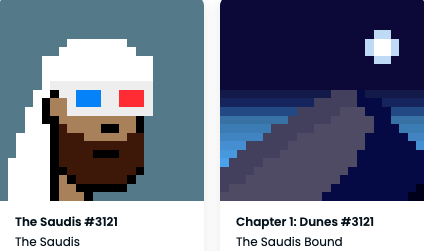

For example, The Saudis NFT project was launched in July 2022. The team has implemented a soulbound token (“Saudibound”) which is tied to individual Saudi NFTs themselves. One reason for this is to ensure that airdrops are tied to the original collection (instead of generating an entirely new collection). A second reason is to reward long-term holders. Specifically, the team is opening a Bazaar where $OIL can be used as currency. The Saudibound token rewards holders who have held the original NFT for longer, with subsequent secondary market sales re-setting the $OIL reward.

I am excited to see other use cases for the implementation of these “non-transferrable” tokens, particularly those tied to solving problem of identity while maintaining user privacy.

Schedule A Consultation

Get in touch! Let’s discuss your specific business needs and how I can help.